The U.S. Steel Corp. is A company with a strong personality

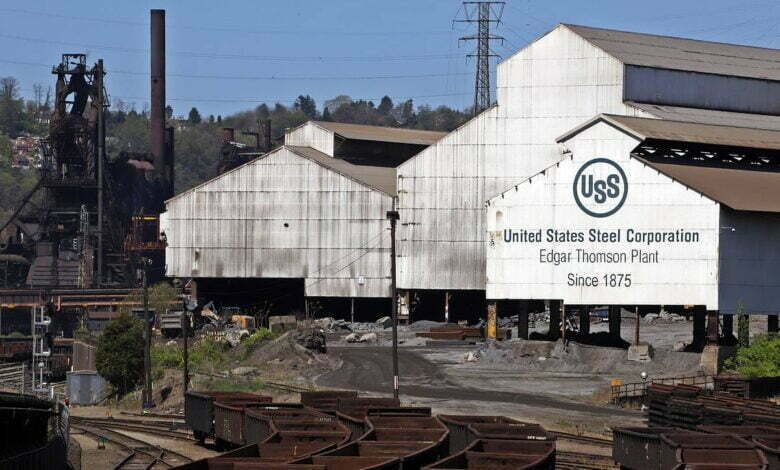

United States Steel Corp. (X), which has been in business since 1875, makes more metal goods than any other company in the United States. The company is constantly improving and producing a wide range of products, such as rolled sheets, spiral-welded pipes, heating radiators, refractory ceramic materials, steel slabs, and round and strip rolled sheets. United States Steel runs a tin plant and makes iron ore, coke, and tin. Long-term, the company wants to make a lot more money by opening up two new factories and areas to make coatings for steel and complex steel parts that can in a lot of different ways, like making electric vehicles.

Below, we’ll discuss in more depth the things that make X’s shares a good investment. · U.S. Steel recently said it plans to sell two blast furnaces at its Granite City Works plant in Illinois to SunCoke Energy. Based on this, the coal company will build a factory that can turn out 2 million tons of granular pig iron annually. U.S. Steel thinks it will take about two years to get a permit for the transaction and build the plant. Then, SunCoke will give U.S. Steel access to Granite City’s cast iron products for the next ten years.

Since the raw materials will come from U.S. Steel’s mines, the company can save much money on this project. FactSet says that the issuer has 5.3% of the global market for rolled steel production. The U.S. has always been the most significant sales market for the company. Germany, Great Britain, and France make up most of the other 21 percent of sales. The first quarter’s adjusted EBITDA was a record $1.3 billion, which shows growth rates in the double digits were mostly because prices for manufactured goods were the highest they had ever been. The operating profit margin reached 22%, which is a little better than the average in the industry, which is 20%. Forty-five percent of the company’s operating profit comes from making cold-rolled steel, the least profitable part of the steel business. In the last few months, this segment has gotten a lot of support because of laws against bullying in China, which is the biggest steel exporter, the implementation of state infrastructure projects, and high building rates.

But the company’s management thinks that the company’s performance may get worse in the year’s second half compared to the first half. The issuer’s market multipliers are currently much lower than the average for the industry and its historical values, meaning there is a 50% upside. Even though the EBITDA margin was historically high at 28%, the EV/EBITDA for the last 12 months was 0.97x. On the local market, Reliance Steel (R.S.) and Steel Dynamics (STLD), two of the issuer’s main competitors, are rated much higher: 4.76x and 2.58x, respectively. At the same time, their profits are between 12% and 1% less than those of U.S. Steel. Based on the averages for the industry, the company. Forward and LTM P/E have median values of 3.3x and 3.4x, while the issuer’s values are 1.7x and 1.02x.

Quotes hit a local low of $16 per share and then went up. This level was a link needed for the “triple bottom” pattern to form, which can be on a chart that goes back 1.5 years. When the RSI indicator falls below 30 points, it confirms that it should stop the downtrend. The closest level of support is still at $16, and the most comparable level of resistance is at the edge of the 200-day moving average at $24. July has been the best month for U.S. Steel stocks, which, on average, have grown by 10% over the past ten years. On July 28, the company will discuss how the second quarter went.

The vital signs that are likely to give X quotes more growth drivers. The number of products sold is decreasing weak demand in the construction and transportation industries; revenue to go up. Another thing that helps U.S. Steel shares is that more than 75 percent of the company’s capital comes from institutional investors. We are lowering the long-term price goal for paper X to $29; prices will happen in the future, yet a new take on how the economy is doing. We think that we should set the stop loss at $13.