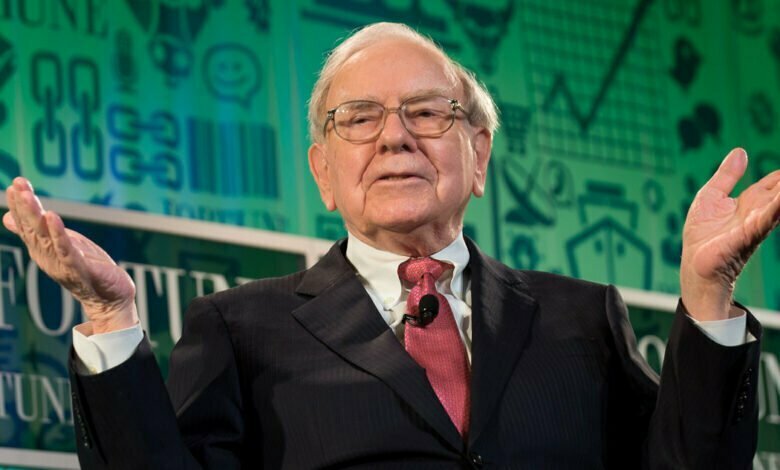

Warren Buffett earned more than $120 billion on the growth of Apple shares

Warren Buffett’s bet on Apple (AAPL) may eventually become one of his most profitable investments, turning into earnings of $120 billion in stocks, as the tech giant broke another record this week, surpassing the market estimate of three trillion dollars. Berkshire Hathaway Holding Company began buying Apple shares in 2016, and by mid-2018, the conglomerate had a 5% stake in the iPhone manufacturer, with a total value of $36 billion.

In 2022, these investments in Apple reached $160 billion, as a large-scale rally in the stock market lasted until the new year. “Without a doubt, this is one of Berkshire’s strongest investments in the last decade,” said James Shanahan, Berkshire analyst at Edward Jones. In addition to boosting Apple’s stock price, it was also a good bet for Berkshire because of its vast payouts. Berkshire receives regular dividends averaging about $775 million per year. Warren Buffett’s dismissive attitude towards high-tech stocks has. Still, over the past decade, the Oracle of Omaha has reconciled with this sector with the help of his investment deputies Todd Combs and Ted Weschler.

The conglomerate is the largest shareholder of Apple, not counting the suppliers of the index and exchange-traded funds. After insurance and railroad interests, the billionaire investor called Apple Berkshire’s third-largest gest business” after insurance and railroad interests.

Warren Buffett has previously said that the iPhone is a “sticky” product that keeps people in the company’s ecosystem. “This is probably the best business I know in the world,” Buffett told CNBC in February 2020. – I don’t think of Apple as a stock. I consider this our third basin over the years, the.” The investor has received part of this profit in actual years.

Since 2018, Berkshire has slightly cut its stake in Apple, and in 2020 the conglomerate received $11 billion. However, due to Apple’s buyback programs, which led to a reduction in the number of issued shares of the company, Berkshire’s total stake in the technology increased. “Berkshire’s investment in Apple demonstrates the power of reverse purchases,” the conglomerate said in its 2020 annual report. “Despite this sell-off [in 2020]- Berkshire now owns 5.4% of Apple. This increase was free for us, as Apple was constantly buying back its shares, thereby significantly reducing the number of outstanding shares.” “But this is not all good news.

Since we also repurchased Berkshire shares for two and a half years, you now indirectly own Apple’s assets and future earnings by 10% more than in July 2018,” Berkshire said in a report to investors. The investment in Apple played a crucial role in helping the conglomerate overcome the Covid-19 crisis in 2020, like other components of its business, including insurance and energy, suffered greatly.